Credit Scores Demystified: What Really Impacts Your Credit and How to Fix It

Most of us know our credit score matters — but very few really understand how it’s calculated, what hurts it the most, or how to repair it when things go wrong. Whether you’re buying a home, applying for a loan, or simply trying to improve your financial health, your credit score can save you (or cost you) tens of thousands of dollars over time.

In this guide, we’ll break down the myths, the facts, and the strategies you need to know to take control of your credit.

Why Negative Items Can Haunt Your Credit for Years

Most negative items (like late payments or collections) stay on your credit report for seven years. If left alone, they eventually fall off on their own.

But here’s the catch: if you pay off a collection, it can reset the clock.

Example:

- A collection was due to drop off in 2 years.

- You pay it today.

- Now it stays for 7 more years from the payment date.

That’s why paying off collections may feel like cleanup, but it can actually hurt your credit in the short term.

Medical Collections: What Changed After COVID

Medical debt has always been tricky, but post-COVID reforms brought major changes.

- Small balances: Medical collections under $500 no longer appear on credit reports.

- Paid collections: Once paid, they must be removed by law.

- Underwriting rules: Medical debt is treated differently than credit cards or loans. Lenders know it doesn’t reflect borrowing behavior, so it’s less of a barrier to getting a mortgage.

💡 Takeaway: If you have medical collections, paying them off now actually helps — they’ll be deleted, unlike other types of collections.

The Real Cost of a Low Credit Score

Your score doesn’t just affect approval — it affects wealth.

- A $500,000 mortgage at 5.7% interest = $3,207/month and $604,468 in interest over 30 years.

- The same loan at 7.4% interest = $3,451/month and $740,000+ in interest.

- That’s $135,000 more because of your score.

Why Missing a Payment Is So Expensive

Credit score tiers change interest rates. A higher rate means you pay tens of thousands more over time.

Example (illustrative):

- Loan: $500,000, 30-year fixed.

- At ~5.7%, payment ≈ $3,207/mo; total interest ≈ $604,468.

- Raise the rate by credit-tier changes and total interest can climb well past $1M over 30 years.

💡 Pro Tip: Put bills on auto-pay. One mistake can cost you thousands.

Credit Karma vs. Real Mortgage Scores

- Credit Karma shows VantageScore; mortgage lenders use FICO (industry versions).

- It’s common for Credit Karma to show 40–60 points higher than mortgage pulls.

- There are hundreds of scoring algorithms; each industry weighs data differently.

✅ Use Credit Karma to monitor trends and errors, not to predict a lender’s decision. For mortgage accuracy, check all three bureaus (Experian, Equifax, TransUnion) and review the full reports.

Credit Utilization: The 30% Rule (and the real target of ~6%)

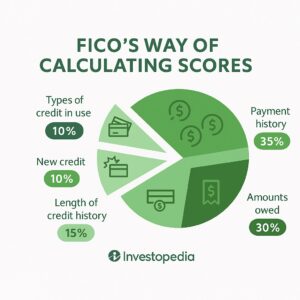

- 30% of your score comes from Amounts owed/utilization.

- Keep each card’s reported balance under 30% of its limit; for best results, aim for ≤6%.

- Scoring models don’t see your bank account; they see ratios.

- A $500 card maxed out can hurt just as much (proportionally) as a $10,000 card maxed out.

- Balances are reported on your statement closing date, not your due date.

💡 Example: If your statement closes on the 4th, pay down your balance by the 3rd for the best results.

Snowball strategy wins: pay the smallest balances to ≤6% first for a quick score lift, then roll those payments to the next card.

Credit Mix & Aging: Keep Old Cards Alive

- Length of credit history and credit mix still matter.

- Don’t close your oldest card; put a small recurring bill (Netflix, gym) on it to keep it active.

- You don’t need many cards; you need well-managed cards.

If you have no credit cards, open one starter card, use $20–$50/month, and pay it off — debit cards don’t build credit.

Types of Credit That Matter

Your score values a mix of credit:

- Credit cards

- Mortgages

- Student loans

- Auto loans

- Personal loans

But note: A $500 card balance can impact you more than a $500,000 mortgage.

Bankruptcy and Counseling Programs

- Bankruptcies can sometimes be removed, but lender wait periods still apply.

- Credit counseling often worsens scores — specifically if they require you to stop paying cards.

- Better options: Debt restructuring, Consolidating with Balance transfers to a credit card, consolidation loans, or professional credit repair.

What Doesn’t Affect Your Credit Score

- Your income or savings

- How much you’ve spent on renovations

- Your personal sense of responsibility

It’s based on cold, hard algorithms — and knowing them gives you power.

Bottom Line

Credit is math plus timing. Focus on the big levers:

- 35%: never miss a payment

- 30%: keep utilization ≤6% at reporting

- Fix errors, handle medical correctly, and avoid moves that re-age old negatives

Credit isn’t just a number. It’s leverage, access, and wealth building tool. The difference between a 620 and a 780 score could mean hundreds of thousands of dollars over your lifetime. With the right knowledge and habits, you can take control — and keep more money in your pocket where it belongs.

Hi, there!

I'm Nisha and I love helping first time home buyers make their first home more affordable and I love helping sellers looking to move up to their forever home. Let me know how I can help you make your real estate dreams come true.

Let's Meet

Contact

(732) 801-7402

Better Homes & Garden Maturo Realty

1 New Road

Kendall Park, NJ 08824

nisha@giveallougot.com

Buy

SOLD PORTFOLIO

Sell

All Articles

schedule your free consultation